It's the equivalent of finding the Christmas gifts your parents tried hiding under their bed. Washington State Senate Democrats have inadvertently leaked their plans for new taxes in 2025 – and unDivided snuck a peek.

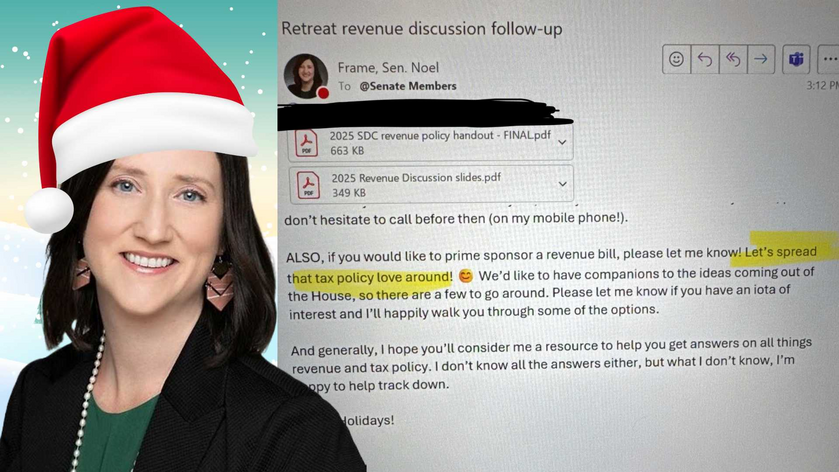

Friday afternoon, Democratic State Senator Noel Frame (Yes, Noel – could you get a better name for an X-mas political story?) appears to have accidently sent an email intended for her caucus to Republicans as well. In the email, provided to unDivided by several of its unintended recipients, Frame summarizes what was discussed at a Democratic "retreat."

The email and its attachments are worse than getting a lump of coal in your stocking. Democrats plan to introduce a string of new tax policies that will target the wealthy, businesses big and small, and allow localities to increase your property taxes at a higher rate.

'Identify the villain'

The word "villain" is used a lot throughout the proposals, as Democrats work to coordinate their messaging on tax increases. The slides contain do's and don'ts of selling the policies to the public.

"Be specific about the villain. Talk about the wealthy few and those who wrote our flawed (sic) tax code 100 years ago."

Don't "focus on the budget hole." Instead, "focus on the solutions and how it will make people's lives better."

Don't say "tax the rich" or "pay their fair share." Instead, say "pay what they owe."

Democrats plan to use the same strategy that was successful in defeating I-2109, which sought to repeal the capital gains tax, in order to sway public opinion in favor of taxing the wealthy and businesses.

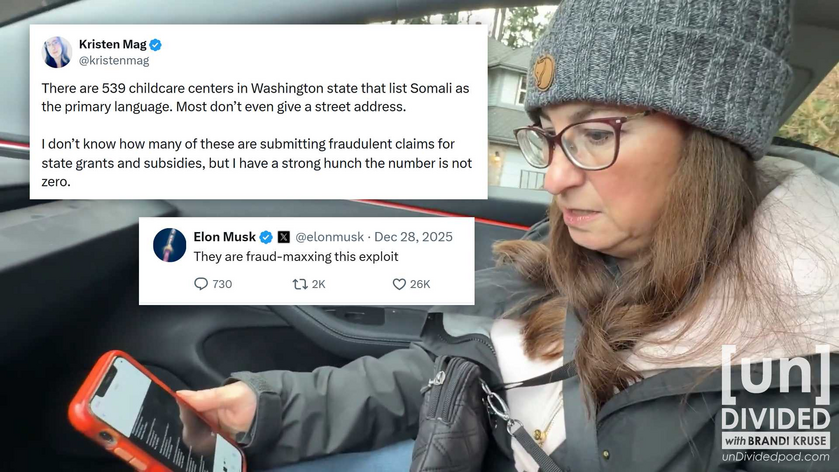

Expanding Seattle's bad tax policy statewide

In the summer of 2020, the Seattle City Council pushed through a tax on high paying jobs (known as the Jump Start Tax) that led the city's largest employer, Amazon, to move 10,000+ jobs to Bellevue.

Now, Democrats want to expand that tax statewide. In the documents, they offer two possible versions. One would replicate the Seattle tax more closely, limiting the tax to only companies with $8M+ in payroll. The second version would be more wide-reaching, removing "the requirement that the company have $8 million minimum payroll, so it applies to all businesses not just big businesses."

Wealth tax

We already knew a tax on unrealized gains was coming, because even Governor Jay Inslee proposed it in his budget – signaling mainstream Democratic support for what used to be a fringe desire of Leftists on the Naughty List.

Add that to the other anti-business taxes, and Washington's largest employers are no doubt looking to migrate south for the winter – or forever.

Add that to the other anti-business taxes, and Washington's largest employers are no doubt looking to migrate south for the winter – or forever.

How the Grinch stole common sense

How the Grinch stole common sense

Not a rich person or business owner? Cheer up, there's still something for you under the tree.

How about an added 11% tax when you buy guns or ammo?

Expansion of the Real Estate Excise Tax?

Or, worst of all, lifting the property tax lid so cities and counties can raise your property taxes at a faster rate.

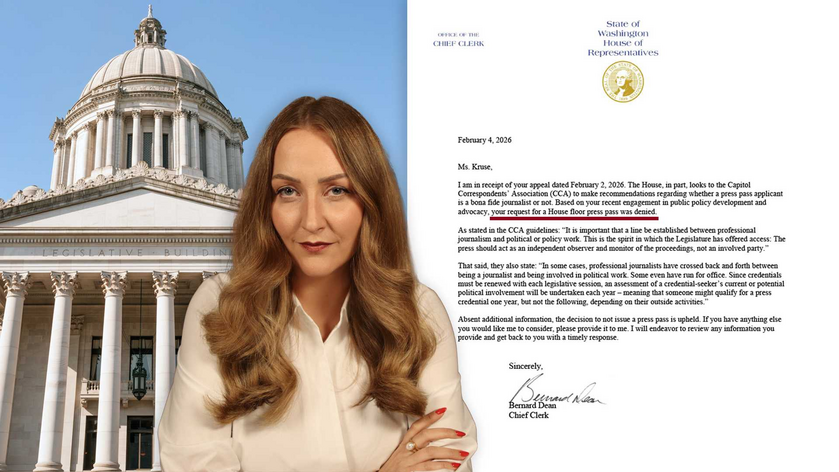

Ignorance is holiday bliss

All of this so Democrats don't have to wrestle with the reality that they have misspent taxpayer funds and failed to budget during times of exceptional revenue growth. While our state's budget has doubled over the past 12 years, Democrats have no plan to take a serious look at spending.

Their excuse for out-of-control spending and a looming budget deficit of $14B?

Inflation.

Bah humbug.